TaxCraft©

TaxCraft©

TaxCraft© is Ichiban's quarterly tax digest that highlights key tax developments and their impact on business operations.

Explore our past editions below:

3Q 2025 3rd October 2025

See how Kenya’s tax landscape is shifting!

See how Kenya’s tax landscape is shifting!

🚀 From KRA leadership changes and simplified PAYE returns to new VAT timelines, SEZ updates and landmark tax rulings - our 3Q2025 TaxCraft© session breaks it all down. Stay ahead of the curve with key insights on:

• Business Laws (Amendment) Bill, 2025

• Recent tax case law shaping compliance

• Global tax trends influencing Kenya

• What to expect in 4Q2025

2Q 2025 11th July 2025

See how the tax changes of 2Q2025 and the Finance Act, 2025 are impacting business. Some highlights:

See how the tax changes of 2Q2025 and the Finance Act, 2025 are impacting business. Some highlights:

• Launch of eRITS to enhance rental property tax tracking through geo-tagging, occupancy monitoring and MRI reporting

• New CRSP for motor vehicles

• ETIMS rollout for fuel stations from 1 July 2025

• Per diem limit raised to KES 10,000 per day

• Removal of the KES 5M SEPT threshold

• Tax losses carried forward capped at 5 years

• Repeal of the Digital Asset Tax

• Commissioner’s prescribed rates (July-September 2025): 8% for fringe benefit and deemed interest and 9% for low interest benefit. U.S. 5% Excise Duty on diaspora remittances

1Q 2025 4th April 2025

See what 1Q2025 had in store for you and your businesses at our latest TaxCraft© session. From NSSF contribution changes to global tax shifts; Ichiban’s quarterly TaxCraft© call (held on Friday, 4 April 2025) unpacked the key tax and regulatory developments shaping Kenya's fiscal landscape.

Some highlights:

See what 1Q2025 had in store for you and your businesses at our latest TaxCraft© session. From NSSF contribution changes to global tax shifts; Ichiban’s quarterly TaxCraft© call (held on Friday, 4 April 2025) unpacked the key tax and regulatory developments shaping Kenya's fiscal landscape.

Some highlights:

• New NSSF contribution limits

• Proposed repeal of excise duty on fully assembled transformers

• Expected VAT reforms signaled in the Budget Policy Statement

• Kenya-Singapore DTA update and looming CRS reporting deadline

• Insights on KRA’s revenue performance and VAT shortfalls

• Landmark tax case law and the path ahead to the Finance Bill, 2025 At Ichiban, we believe tax conversations should inform debate and shape policy

TaxCraft© is our way of simplifying the complex, making tax policy accessible and empowering you and your business with insight that you can act on

4Q 2024 17th January 2025

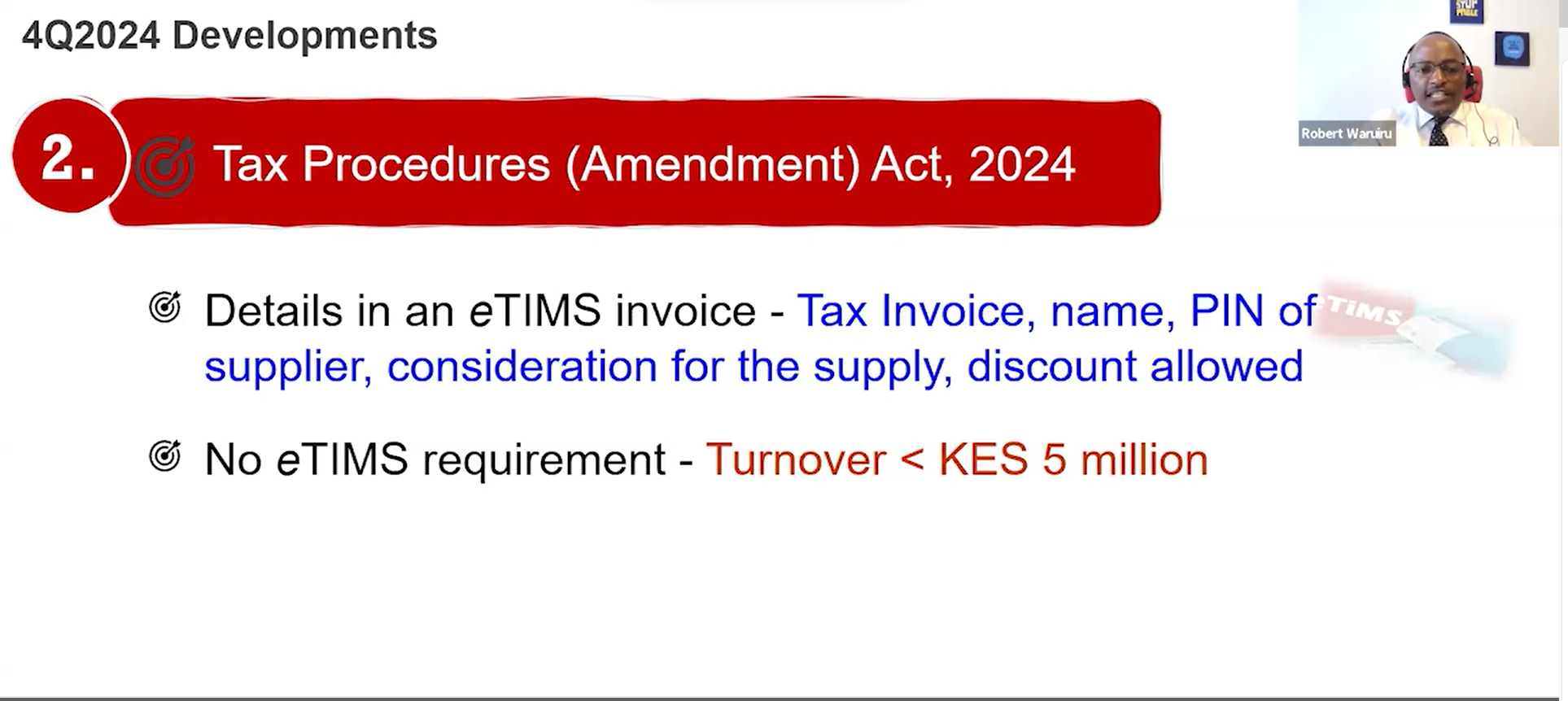

See how 4Q2024 developments & the 2025 business outlook are likely to impact you and your business in 2025 and beyond. Key insights:

See how 4Q2024 developments & the 2025 business outlook are likely to impact you and your business in 2025 and beyond. Key insights:

• Impact of the significant economic presence tax and minimum top-up tax on businesses in the digital economy

• Key updates on employee benefits and personal taxation

• Impact on goods supplied to public entities and digital marketplace payments

• Compliance essentials

• How global tax reforms are shaping the local landscape

3Q 2024 4th October 2024

See how the tax changes of 3Q2024 are impacting business. Some highlights:

See how the tax changes of 3Q2024 are impacting business. Some highlights:

• The treatment of SHIF post October 2024

• The CA decision in The National Assembly and SNA v Okiya Omtata

• How Nigeria is taxing Crypto and how that is likely to affect Kenya

• How the UN Framework on International Tax Cooperation is changing how governments share information related to tax

.png)